Latest News

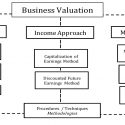

Very Basics of Business Valuation

The term “value” means different things to different individuals. I’m not sure who made that statement many years ago, but it still holds true today. The perceived value depends on the interpretations, circumstances and role of the shareholder(s). Without carefully defining the term “value”, a conclusion reached in a valuation report will have no meaning.… Continue >>>